As we all know, the stock market can be considered as the barometer of the economic situation. And as investors, being aware of the biggest market crashes in history can be wise. Indeed, it gives you a better understanding of the stock market and the cyclical nature of markets. In this post, I will highlight the 5 most serious market downturns beginning with the Tulipmania, known for being the first market crisis in history.

1. Tulipmania (1636-1637)

In the 17th century, the tulip bulbs became a luxury item and sign of status in the Netherlands. Prices steeply raised due to greed and speculation with some tulip bulbs traded at higher prices than a house1. Just before the tulip bulbs market bubble bursts, the most wanted could be sold for the equivalent of 10 years of average annual salary2.

However, in 1637, the bulbs market crashed and prices collapsed. Buyers borrowed money to acquire bulbs expecting to sell them at even high prices but that led to financial ruin.

2. The Great Crash (1929)

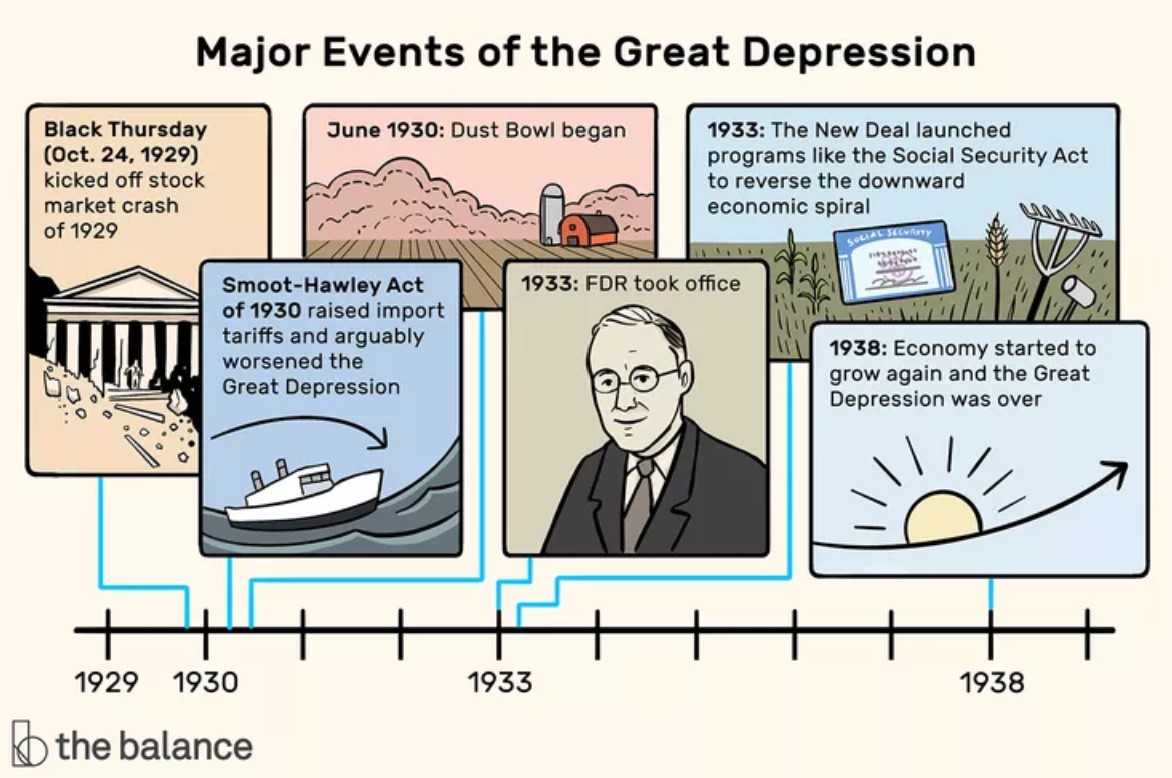

Almost 300 years later, we had a stock market crash which triggered the Great Depression. At the end of October, Wall Street went through a meltdown with the Dow Jones Industrial Average plummeting by 25% in a few days and 50% by mid-November3. The aftermath was devastating with bank bankruptcies and widespread unemployment. This crash has been caused by an overvalued stock market and poor banking structures/regulations.

3. Black Monday (1987)

The October month seems to bring bad luck for the stock markets. On october 19th, global stock market crashes and the Dow Jones decreased by 22.6% in just one day4. The main reasons behind the Black Monday are computerized trading, high valuations, and market psychology. Unlike 1929, the market recovered relatively quickly, thanks to central banks and financial institutions’ interventions.

4. The Dot-Com Bubble (2000)

At the end of the 1990s, the rise of the Internet and tech companies made the market skyrocket. The “dot com” companies were sure to receive massive investments often without revenue, just because it has a “.com” suffix in its name. By 2000, the NASDAQ Index had reached astounding heights. The bubble was however not sustainable and by October 2002, the NASDAD had decreased by 78% from its peak5. What followed is a recession that redefined the landscape of the tech industry.

5. The Global Financial Crisis (2008)

In 2008, The subprimes crisis triggered the most severe economic downturn since the Great Depression. The overuse of complex financial products linked to U.S. home mortgages led to a global financial crisis. Major financial institutions (Lehman Brothers for instance) collapsed, which urged massive bailouts and central banks interventions. The Dow Jones dropped by 54% in 18 months6 and the aftermath was global with recessions in numerous important economies.

As we have just seen, crashes often repeat themselves but each time with its unique set of causes. For those investing in the stock market, understanding thoroughly the past market crashes can provide a real added value. As we all know, markets are always unpredictable (those claiming otherwise will mislead you) but savvy investors can navigate through rough seas without too much trouble.

The key takeaway from this article is that no matter how serious the crash is, the market always seems to recover from difficult periods with outstanding performances afterwards. These crashes serve as a poignant reminder that just like human beings, the markets have their ups and downs !

1Tulip mania: The flowers that cost more than houses

2Turkish delight – ft.com

3Here Are Warning Signs Investors Missed Before the 1929 Crash

4STOCKS PLUNGE 508 POINTS, A DROP OF 22.6%; 604 MILLION VOLUME NEARLY DOUBLES RECORD

5Looking back on the crash

6How to calm clients worried about stock market swings

Leave a Reply